ri tax rate on unemployment benefits

7 press release from Gov. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

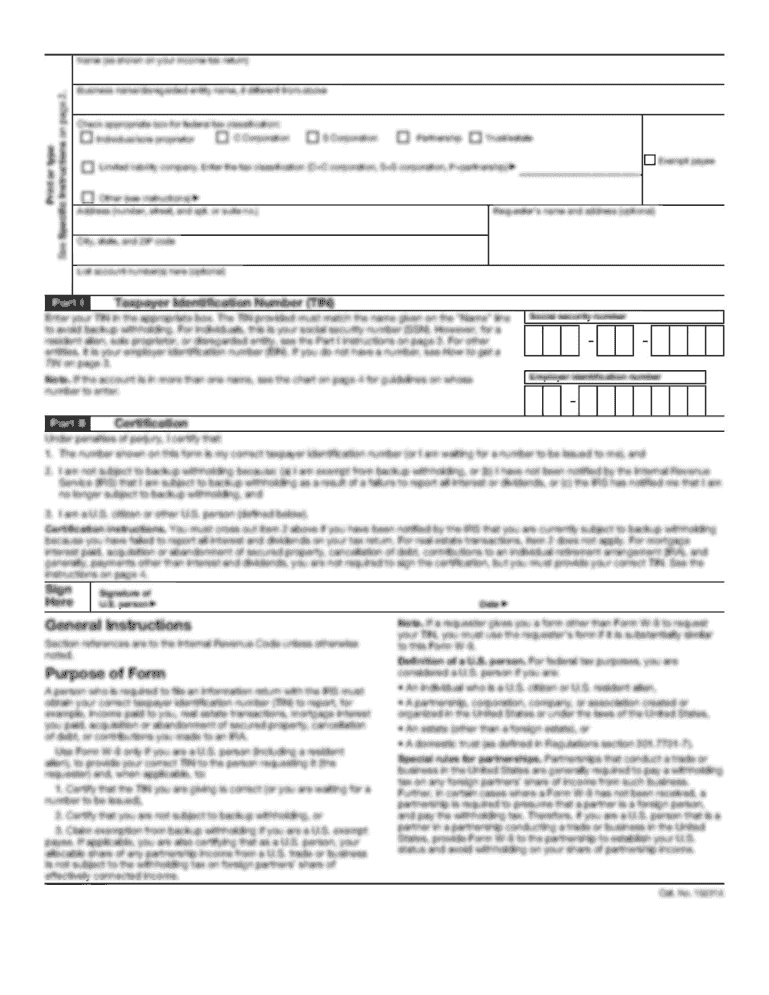

1099 G Rhode Island Fill Out Sign Online Dochub

These rates include the 021 percent Job.

. State Taxes on Unemployment Benefits. Rhode Island unemployment insurance UI tax at a glance 2020 2021 Taxable wage base 24000 24600 Tax rate schedule F H Tax rate range 069 to 919 099 to 959 Tax rate. For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100.

South Carolinas unemployment insurance tax rates will decrease or remain unchanged for all employers in 2023 according to a Nov. That means employers whose rates now range from 12 to 98 will see their rates remain steady. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent.

UI provides temporary income support to workers who have. For most Rhode Island employers the taxable wage base for calculating. State Income Tax Range.

52 rows New Employer Tax Rate 2022 Employer Tax Rate Range 2022. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

Up to 25 cash back The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next. Unemployment tax rates are. The rate for new employers which is based on the States five-year benefit cost rate for new employers will be 119 percent.

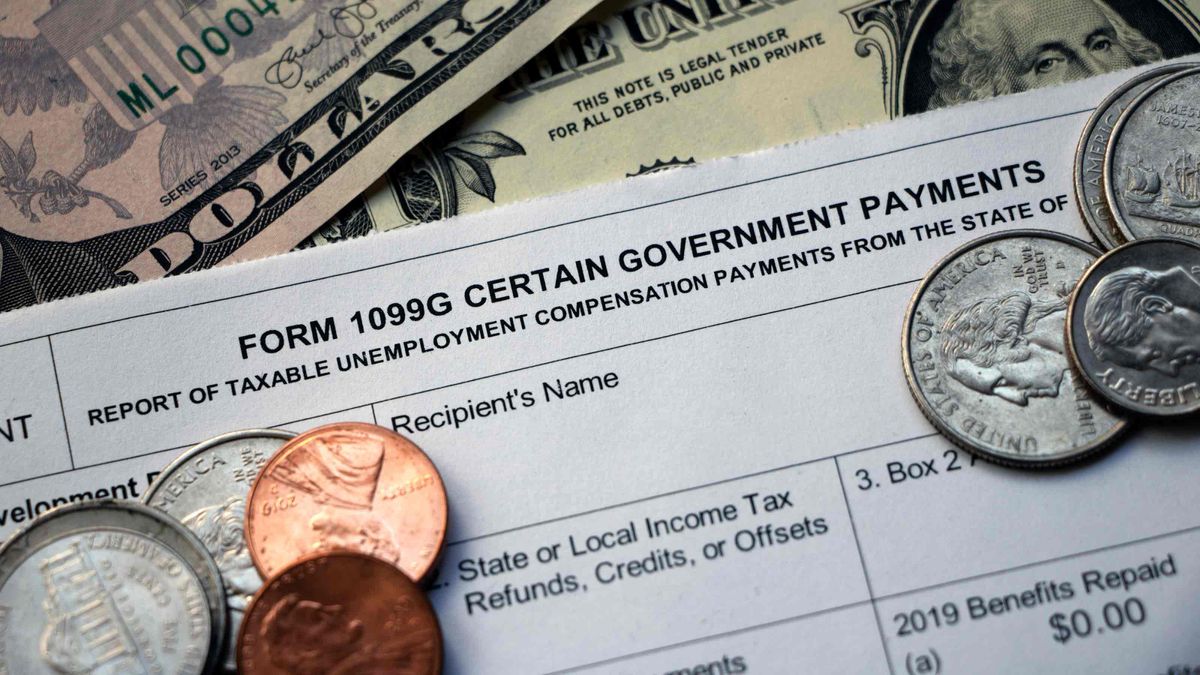

Delaware taxes unemployment compensation to the same extent that its taxed under federal law. For those employers at the highest tax rate the UI taxable wage base. Notwithstanding the foregoing for weeks ending on or after May 1 2021 through June 30 2022 wages includes only that part of remuneration for any work that is in excess of.

The rate for new employers will be 119. The Rhode Island Division of Taxation today provided guidance explaining. The rate for new employers will be 116.

Division reminds taxpayers and tax preparers about existing Rhode Island statute. 020 680 including Employment Security Enhancement Assessment of 006. In recent years the employment.

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Unemployment Tax Changes Throughout The Country In 2022 And 2023 First Nonprofit Companies

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Taxes On Unemployment Benefits A State By State Guide Kiplinger

![]()

Unemployment Insurance In Rhode Island Ballotpedia

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022

7 5 Million Workers Face Devastating Unemployment Benefits Cliff This Labor Day

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Tracking Unemployment Benefits A Visual Guide To Unemployment Claims

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Analysis U S States Ending Jobless Benefits Early Hit Labor Market Milestone In March Reuters

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Insurance In Rhode Island Ballotpedia

State Unemployment Compensation Trust Funds May Run Out In Weeks

Unemployment Insurance Tax Codes Tax Foundation

Andy Boardman Here S How A Rhode Island Employment Bonus Proposal Would Work And How It Can Be Improved

Apply For Unemployment Benefits Ri Department Of Labor Training